Determining Your Baselines

Each dealership will have different marketing goals. For many, these are not fully developed, which poses challenges when trying to understand what success is and if it is achieved. Whenever something is focused on, it is usually improved. Marketing, in any form, can be confusing and complex. Dealership Leaders can feel overwhelmed quickly when trying to understand the metrics placed before them, especially if they have had limited exposure to the numbers. This can lead to the proverbial Mouse guarding the cheese.

The bigger challenge is when any Business Manager starts with a marketing plan without the benefit of completing a Business Plan first. If you are reading this and have not completed your Business Plan, do yourself a favor, stop, and go work on that instead. Business owners and managers are limited in terms of time. Use this time to build that plan first. Ideally, your plan should have exact measures for the year’s remaining months and the next two years ahead. Automotive Dealers should be able to articulate sales by Department, Gross, and Net Revenue and agree with the Department heads regarding achieving the goals. If you have this completed, you should have a clear understanding of exactly what you are going to sell next month and how much money you are going to make in doing so.

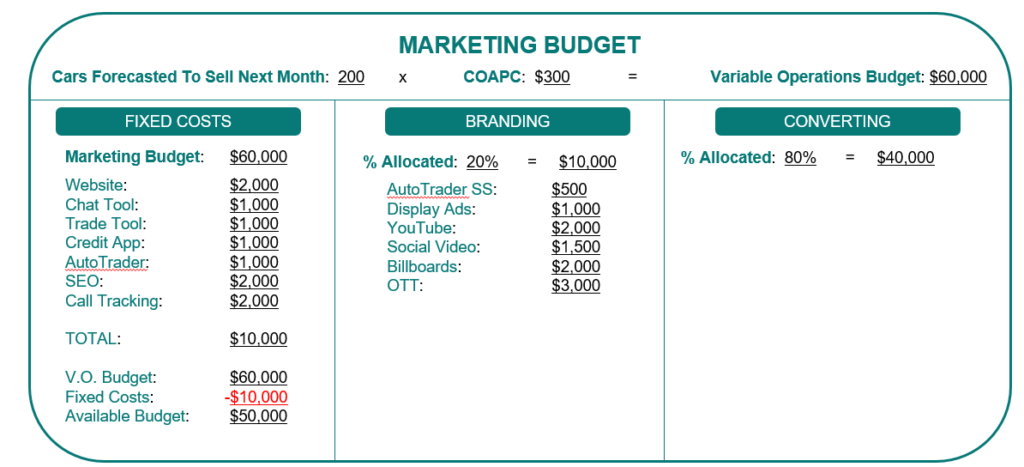

In your Business Plan, you should have a calculation for the Marketing budget. This budget should fluctuate based on sales expectancy for the next month. Many Dealers relegate this to a metric known as the cost of advertisement on a per-car basis. (COAPC) This metric can provide clear guidance throughout the year and can simplify your understanding of key reports and performance indications. This number has significantly increased over the last five years for most Dealerships. In 2019, dealers planned for $350 to $400; in 2024, dealers are reporting to be as high as $670. Rural Dealers with low competition or who are part of a Larger Auto Group (relative to the area) can spend less. Dealers in higher competitive Domestic Markets tend to pay more.

Once this is determined, the following metric splits the Marketing budget between branding and conversion needs. It is recommended that a percentage of the total budget be utilized to achieve this split. Again, Dealers that are part of a known Auto Group can utilize a smaller split for branding: Typically 15 to 20% allocation in branding. New stores, especially new single-point non-franchise locations, will need to exercise a larger budget with a higher percentage of branding: typically 45 to 50%. On average, Dealerships are recommended to allow for a 20-25% split in branding.

For the examples illustrated we will look to a store that has a $400 COAPC with a 20% Branding budget.

A question we receive often is how this allocation changes between new, used, and certified vehicles. This is a worthwhile exercise. However, it can feel overwhelming if a Dealership is just acclimating to budgeting in this format. It is advisable to use a blended number for all vehicle marketing

What is Branding in Automotive Marketing?

All marketing should be done with a purpose. This includes Branding. In the example of a store wanting to increase sales for New cars, it will want to consider the path that all consumers take in making a purchase.

The first step is for the consumer to become aware of the product. This can be measurable and also immeasurable. This is the paradox suffered by every marketer. Awareness, for a new vehicle, can begin at a multitude of points in a consumer’s life:

- They watch commercial for a different Dealershio

- They see the vehicle at a gas station, in the school drop-off line or repair shop.

- A friend or family member purchases one.

- They see a post on social media,

- A character in a television show they watch drives one.

This list is limitless as is the impact that it has on the consumer. All of these instances listed are immeasurable yet impactful on the consumer’s journey.

At the same time, while the vehicle branding is important, so is the Dealership and even the sales rep itself. Helping a customer understand where to buy is, of course, as important as what to purchase. Often Dealers tend to focus efforts on one method over the other-however both are important to ensure conversion success. There are many methods that Dealerships can deploy a multitude of methods in Branding – many of which do not carry a cost. The purpose of this article is to focus on those with a cost association.

Branding In The Path To Purchase

In every purchase, a consumer moves from the aforementioned step of awareness to consideration. Consideration is the ruling in or ruling out of a product type, place of purchase and even the person they would purchase from. Some examples of this would be A salesperson helping someone out at a volunteering event and having a conversation. During this conversation, they discover that the person is in the market for a used vehicle. The salesperson builds rapport, which shifts the consumer from consideration to interest in working with them in the purchase of the next car. In another example, a customer is online and has not yet determined a specific vehicle when they see an Automaker ad that touches them emotionally. While they do not know exactly what they want to purchase, they know they want to purchase within that Make. In both scenarios the consumer has been affected by a form of branding and has shifted from Consideration to Interest.

Typically, in Marketing, Dealerships utilize a multitude of mediums for branding. Television, Radio, Billboards, Newspaper ads, Car listing sites (e.g., AutoTrader, Cars.com), and even paid search and social placements. While these are all forms of branding, they are measured slightly differently.

The goal is to get a message in front of an audience. Ideally, it should be in front of people intending to purchase a vehicle. Billboards and broadcast radio are broader forms of messaging. Since these forms of communication are not designed to start a conversation with the Dealership directly – they can not be fairly measured by conversions. (Calls, Chats, Leads…etc). This leaves no place for “Buy Now” messaging as the audience is not ready to buy now. Instead, this should be used to garner awareness and consideration in the vehicle, brand, Dealership, and even the Salesperson.

Measuring Branding Impact

This can be the toughest part. As a Dealership elects to advertise on a platform, it is important to understand what the audience size is and what percentage of that audience is potentially in the market for a vehicle. Platforms like cars.com and AutoTrader are designed for one type of audience-car buyers and car shoppers. Due to the complexity of the effectiveness of these platforms, it is best to consider it in two parts. First, whether you should list your vehicles on the platform. That will be a separate article. Secondly, whether or not you should advertise on the platform. (e.g. Billboards, Skyscrapers, Search result load screens). The latter is best to consider in branding, and the former is in the top line of budgeting.

Advertisements on the site can be measured in impressions. This can be, and should be, provided to you in the monthly reporting. How many shoppers saw the ad? The next factor to consider is the engagement. How many people clicked on the ad?

In Paid Search, such as Display, this can be measured evenly: how many impressions and how many clicks/engagements with the ads. Comparing these two is not apples to apples, though. Targeting the display ads can get somewhat level the playing field a bit. Targeting known in-market shoppers, retargeting campaigns for viewers of website VDPs,and careful term targeting can reduce the spend and increase valuable impressions.

To balance this, the Dealership needs to establish a target CPM. This is a metric that attributes a cost per 1,000 impressions. If a Dealership knew the message would get in front of people that they were certain to be in-market, it is reasonable to pay a higher CPM. Keep in mind the goal is not to sell at this stage. This is for converting. We want to have conversations with those who are ready to buy – not just entice them to consider us.

Keeping in mind that the goal is to raise awareness and consideration. This means a wider audience. This places measurement on impressions first and engagement second.

Two of the most challenging mediums to gain this information from is radio and billboards. Both do have a place in marketing. In Billboards, the listing agency can give you an estimation of drive-bys. This number is an estimation. The benefit to this number is that you know the passers-by are in an area with the exception of highway and tollway signs. You also can estimate that more than half of the drive-bys are duplicated as people head to and from work daily. Some people also drive by during lunch hours, running errands and the like. At the same time, impressions online are not unique, so take them under advisement.

The next consideration with this is the number of those drive-bys that are in the market for a vehicle. This could be relegated based on the number of drive by versus the percentage of buyers versus the number of licensed drivers. In the United States the number of new cars sold averages around 16 million, while the number of used cars is close to 34 million. There are approximately 233 million licensed drivers. Therefore it could be concluded that one in four drivers are in the market for a vehicle, rounding down to consider those that share vehicle and other factors.

Since the start of covid, there has been some pent-up demand for vehicles. So, the opportunity to sell more (or less) is strongly impacted by the first two stages of the path to purchase. It also may indicate that the above rounding down may be understated. The consistent application of the metric and making a decision on the metrics is important to derive a starting point. Once decided it can be applied and aids in unifying decisions more easily.

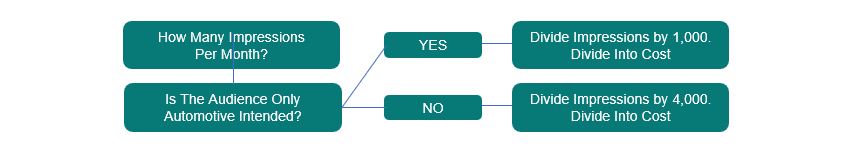

This means we can compare sites like AutoTrader to Billboards though anything could be argued. Based on this determination we expect 4 times the impressions of non-automotive audience impressions compared to traffic that is not automotive focused.

Since the goal is impressions, the more that we gain per dollar becomes the measure of success. If AutoTrader provides a skyscraper ad for $300, which produces 30,000 impressions, that would equate to a $10 CPM. By comparison, if the Billboard received 120,000 drive bys per month and sold for $600 the CPM would be $5. Since the former is automotive intended and the latter is not, the billboard should be calculated at a 4x multiple of cost to be more evenly measured. So the spend on AutoTrader would be a better investment of branding at $10 compared to the billboard at $20.

With this formula you can easily divide your branding efforts into two categories: Auto Intended and Not Auto Intended. So either the audience is only looking to purchase or shop for a vehicle in the place the ad is being shown, or they are not. Mediums like radio, television and non-targeted CTV and OTT are Not Auto Intended. Correctly targeted OTT, correctly targeted CTV, Cars.com, AutoTrader..etc: Those would be Auto Intended. Now you can easily do the math and calculate accordingly.

Applying The Math To Your Budget.

With the above factored in, it becomes easy to display this in a methodology that will make measuring success easier to understand. In recap, the Cost of Advertisement on a per car basis was decided at $300 and the store forecasted 200 units for the next month. That equates to a $60,000 budget. In the table we subtract, on the left, the fixed costs that are recurring and are not a part of Marketing but are not variable. This can include listing sites like AutoTrader listingsor this can be moved to Branding or Converting depending on strategy. (This will be illustrated in a later post). With the fixed costs listed and totalled, the amount is subtracted from the Marketing budget to understand the available budget. (e.g. $50,000).

The percentage of 20% was decided as the allocation to Branding campaigns and efforts. This equates to $10,000 in this example.

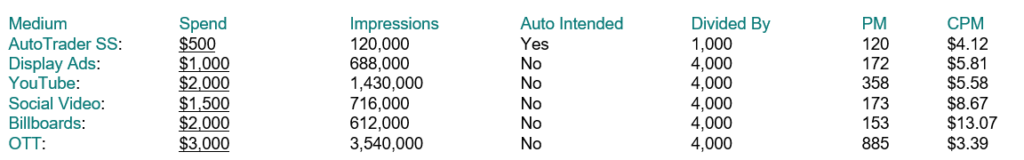

Taking the reports from the advertisers (note this is real data but masked to protect the Dealer) we can apply the calculations based upon the information above. This makes comparison across mediums easy. From this perspective we can see the Leader in CPM is OTT. Billboards has the highest cost on a CPM basis.

Bringing It Together

Understanding the data can sometimes mean knowing the numbers, as shown here, but it can also mean that a plan was made that can create exclusions in the consideration. Often, a Dealer finds the need to pay a higher CPM for other strategic reasons.

For example, a Dealership may have two Billboards open nearby. Advertising Dealers may purchase these to gain attention from their customers and potential customers via conquest. This can minimize the Dealers’ presence in the market despite a higher cost. In this case, moving that cost to the Fixed cost column would be recommended.

Separately, suppose the dealer is promoting a new initiative such as home delivery or oil changes for life. In that case, the dealership may allocate a higher budget temporarily to increase awareness in the short term. This would include a higher percentage of these campaigns, which can often misalign the CPM comparisons.

Keep a ledger of expenses, reasoning, and expectations. Most importantly, do not let a campaign run for any month without knowing what success will look like and inspecting what you expect.